AUM heavyweights SBI, HDFC and ICICI Pru flex muscle, adding Rs 2 trillion+ each.

Mutual fund houses saw robust asset growth in the third quarter, with the industry’s assets under management (AUM) expanding nearly 40 per cent year-on-year.

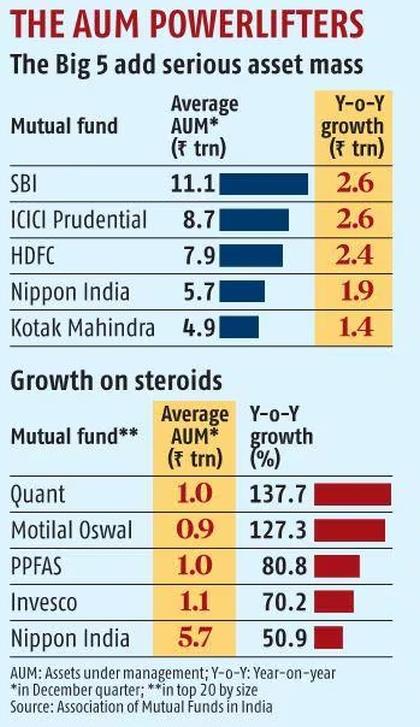

Key players like SBI, ICICI Prudential, and HDFC played a pivotal role in this AUM growth, each boosting their average AUM by over Rs 2 trillion during the year.

Collectively, the top five fund houses saw their assets swell by Rs 11 trillion, representing more than half of the MF industry’s total AUM growth of Rs 19.4 trillion.

Among the 20 largest fund houses, Quant and Motilal Oswal reported the highest percentage gains in AUM, with increases of 138 per cent and 127 per cent, respectively.

The latest quarterly AUM data shows that MFs together managed Rs 68.6 trillion during the quarter ending December 2024.

In the same quarter the previous year, the average AUM was Rs 49.2 trillion, according to data from the Association of Mutual Funds in India.

AUM growth is influenced by two main factors: Market performance and net inflows.

The mark-to-market impact on AUM has become more pronounced as the share of equity and hybrid MF schemes has risen. Active equity funds alone had an AUM of Rs 30 trillion in November 2024.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Rajesh Alva/Rediff.com