Equity benchmark indices Sensex and Nifty slumped over 1 per cent on Tuesday, weighed down by an across-the-board selloff amid cautious investors approach ahead of the US Fed interest rate decision.

Photograph: Shailesh Andrade/Reuters

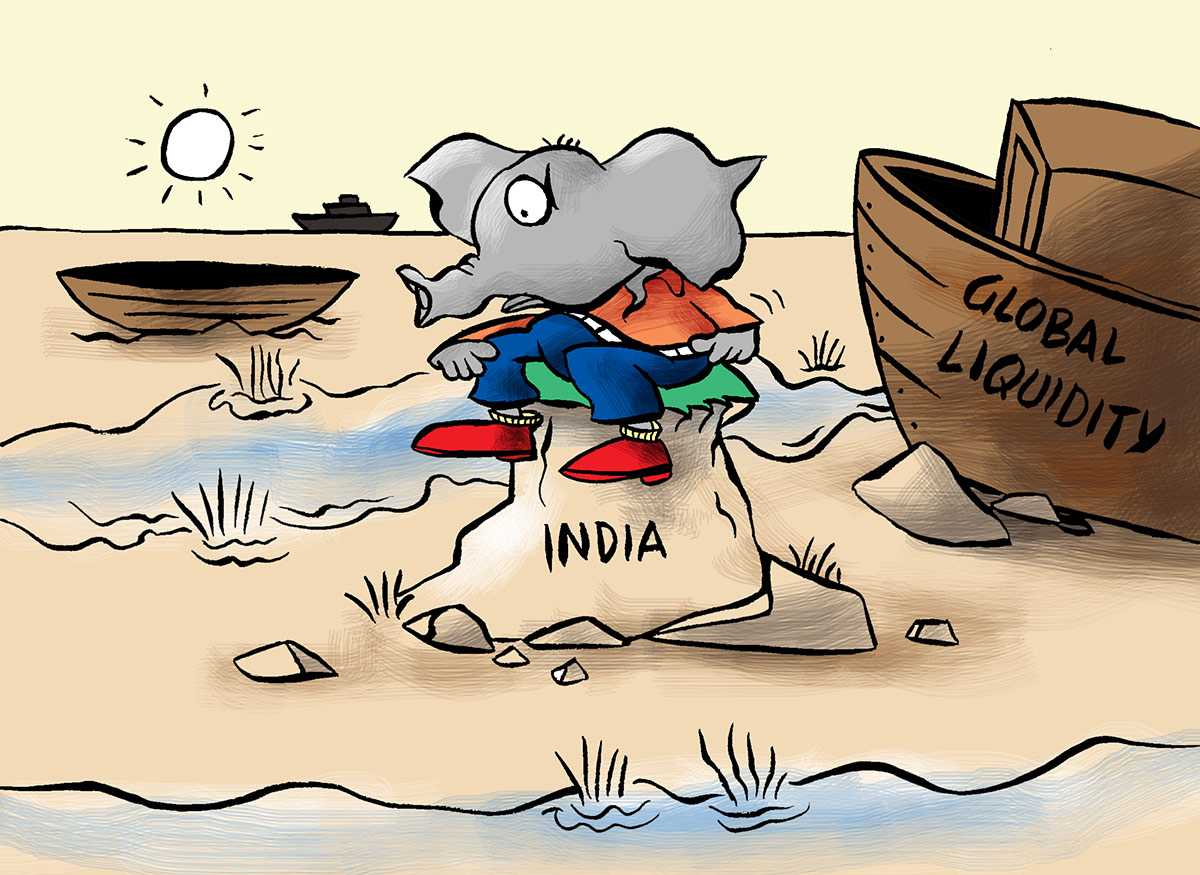

Besides, the continued flight of foreign capital from Indian markets amid a negative global market trend also affected the sentiment, traders said.

Falling for the second day in a row, the 30-share BSE benchmark Sensex tanked 1,064.12 points or 1.30 per cent to sink below the 81,000 level at 80,684.45.

During the day, it slumped 1,136.37 points or 1.39 per cent to 80,612.20.

As many as 2,442 stocks declined, while 1,576 advanced and 89 remained unchanged on the BSE.

The NSE Nifty tumbled 332.25 points or 1.35 per cent to 24,336.

“Widespread pessimism prevails across all sectors ahead of key policy decisions from the US Fed, BoJ (Bank of Japan), and BoE (Bank of England).

“While the market has already factored in a 25 bps cut from the US Fed, it remains vigilant for any hawkish signals.

“The BoJ and BoE are largely expected to maintain their current rates for the year.

“Concurrently, the rupee has depreciated to an all-time low, and a record-high trade deficit is exacerbating the pressure,” Vinod Nair, head of research, Geojit Financial Services, said.

From the 30-share blue-chip pack, all firms ended in the red.

Bharti Airtel, IndusInd Bank, JSW Steel, Tata Consultancy Services, Asian Paints, Larsen & Toubro, Reliance Industries and HDFC Bank were the biggest laggards.

The BSE midcap gauge declined by 0.65 per cent, and smallcap index slipped by 0.52 per cent.

“The liquidity deficit in the Indian banking system hit the highest in nearly six months on advance tax payments by companies and likely dollar sales by the central bank to curb rupee volatility.

“Banking stocks were a major drag on the indices, as Bank Nifty closed 1.5 per cent lower for the day,” Devarsh Vakil – deputy head retail research, HDFC Securities, said.

All sectoral indices ended lower. BSE Telecommunication tanked 2.18 per cent, metal (1.77 per cent), auto (1.70 per cent), energy (1.64 per cent), oil & gas (1.59 per cent), commodities (1.39 per cent) and financial services (1.37 per cent) were the major laggards.

“Indian benchmark equity indices continued their decline for the second consecutive session, losing nearly 2 per cent since Friday, driven by weak sentiment in global markets ahead of the US Federal Reserve’s meeting outcome.

“Globally, markets are focused on the outcome of the Federal Open Market Committee (FOMC) meeting.

“While a 25 basis points rate cut has already been priced in, attention will be on the commentary from the Fed chair,” Ameya Ranadive Chartered Market Technician, CFTe, Sr Technical Analyst, StoxBox, said.

“In global markets, there are worries that the Fed might signal a pause or a slowdown in the pace of rate cuts ahead and would give a cautious outlook for the policy meetings that follow after this Wednesday’s meeting where it is widely expected to cut rates by 25 basis points,” Vakil said.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 278.70 crore on Monday, according to exchange data.

Global oil benchmark Brent crude declined 0.50 per cent to $73.58 a barrel.

“The decline came amid weak FII volumes and heightened caution ahead of the US Federal Reserve’s monetary policy meeting, which is expected to provide cues on the trajectory of interest rate cuts going ahead.

Investors will watch out for US retail sales data to be released later today.

“Despite the market volatility, there is continued action in the primary markets with eight new IPOs opening for subscription this week and three IPOs including One Mobikwik, Vishal Mega Mart and Sai Lifesciences listing on the stock exchanges tomorrow,” Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services Ltd, said.