The moderate power, freight and credit data do suggest GDP estimates could be revised down, says Devangshu Datta.

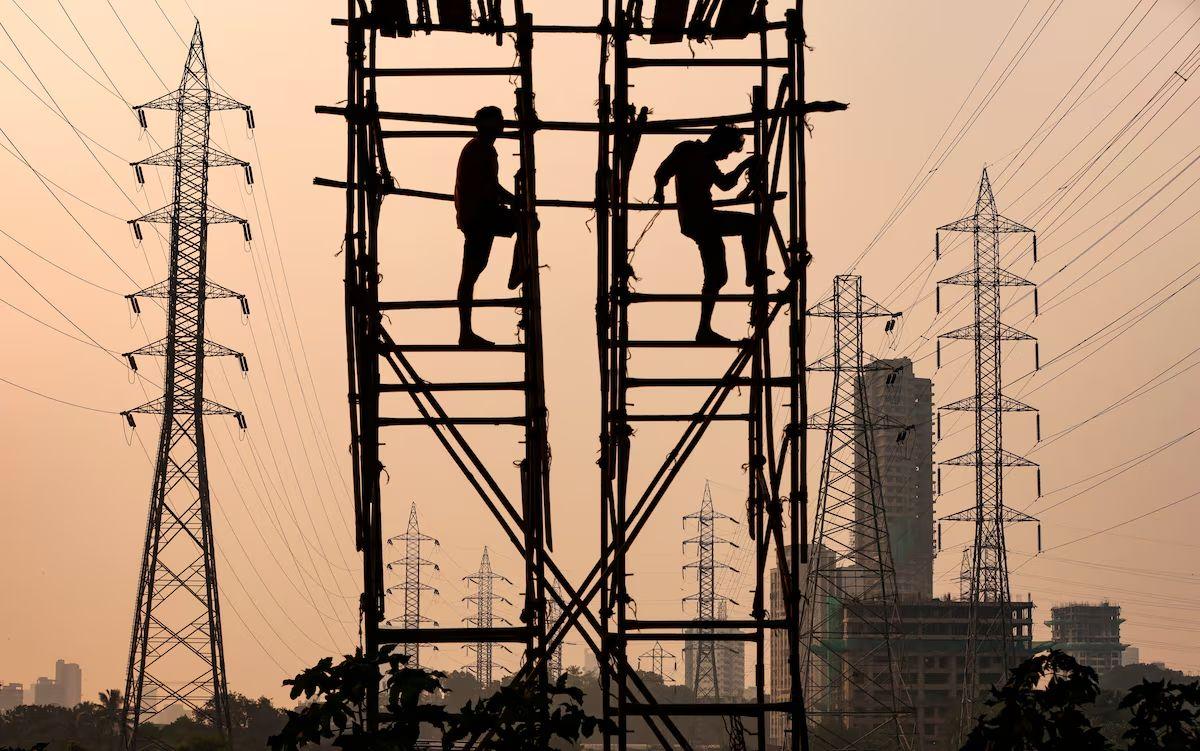

Photograph: Francis Mascarenhas/Reuters

There are some apparent paradoxes visible in the data from the first quarter of 2025-26 (Q1FY26).

The gross domestic product (GDP) delivered a positive surprise with 7.8 per cent year-on-year (Y-o-Y) growth.

But electricity consumption fell 1.5 per cent Y-o-Y, a drawdown not seen since the Covid lockdowns.

At first glance, the GDP data would seem overstated. Power consumption, which is metered, correlates closely with economic activity and is likely to be more accurate than GDP calculations.

But there may be another explanation, one that indicates future challenges for the power sector.

High rainfall meant there were only 12 days with above-normal temperature and humidity, so cooling demand was low.

Beyond industrial needs, the increasing penetration of air conditioners in middle-income households is contributing to cooling demand.

Extrapolating, household cooling could account for 20 – 25 per cent of power demand by 2030, leading to demand surges in hot, humid weather.

One consequence of climate change is wild weather patterns.

Power demand volatility is related to weather volatility.

Generators and discoms will have to develop accurate forecasting models since capacity expansion, and generation mix must be calibrated to be financially viable when demand is low, and to ensure no supply shortfalls occur at peak demand.

This will require smarter grids and much smarter forecasting.

Price data from energy exchanges where power units are traded offers further insights.

On average, the price of units was lower, which gels with lower demand. Data from the day ahead market (DAM) and real-time market (RTM) shows clear trends.

RTM volumes exceeded DAM volumes for the first time ever in Q1FY26 – a reversal, since DAM volumes have been much higher than RTM volume in the past.

In June of Q1FY26, DAM prices fell from record peaks of around Rs 6.95/unit in Q2FY24 to below Rs 4/unit.

Nine of the last 10 months have seen month-on-month declines in DAM prices.

In the RTM market, prices dropped to nearly Rs 0/unit between 7 am and 1 pm, and spiked to as high as Rs 5/unit between 8 pm and midnight.

This seems to be the norm during April-October.

The diurnal variations are huge. On the same days, RTM units were sold at a few paisa/unit and also at above Rs 5/unit.

This is due to the intermittency of solar power, which is by far the largest component of renewable energy (RE) wheeled onto the grid.

As more RE comes online, coping with that volatility will become an ever bigger challenge.

During sunlight hours, there are big surpluses.

At night, shortfalls occur as solar no longer contributes and price surges.

Peak RTM demand in summer typically occurs between 2000 and 2400 hours (8pm and midnight). Solar is off at that time.

On most days in Q1FY26, night-time supply was 10 per cent below demand, with shortfalls reaching 90 per cent sometimes.

Conversely, during peak solar hours (0700–1700 or 7 am–5 pm), supply was nearly three times the demand.

RE capacity is scaling up at 25-30 Gw per year. There’s a case for a big push on the storage front, to ensure surplus solar units can be used at night.

One scheme that supports this is viability gap funding (VGF) for battery energy storage systems (BESS) projects.

The VGF covers 30 Gwh (Gigawatt hours) of capacity with an incentive capped at Rs 18 lakh /Mwh (Megawatt hours).

This is expected to fund BESS requirements till FY28.

Apart from the cash incentive, it offers 100 per cent waivers on interstate transmission system (ISTS) charges. BESS costs are also likely to drop sharply as technology scales, making investments attractive.

The diurnal high-low differentials on RTM units of about Rs 4.85/ unit, indicate BESS investments may be viable even without VGF.

Of course, as storage catches on, peak unit prices will also drop.

But battery technology will get cheaper at great pace, ensuring storage stays financially viable.

Returning to GDP data and the famous three-variable Li Keqiang Index, rail freight volumes grew 2 per cent Y-o-Y in Q1FY26, and bank credit offtake grew 9.5 per cent.

Taken together, the moderate power, freight and credit data do suggest GDP estimates could be revised down.

Regardless, the trends of high volatility of power demand and price fluctuations caused by RE-related intermittencies will only grow, given climate change, rising AC usage, and decarbonisation.

The sector needs massive investments in storage, in smart grids and in forecasting models.