IDFC First Bank on Monday said its shareholders have rejected the proposal to allow global private equity firm Warburg Pincus’ arm to nominate a non-executive director on the bank board.

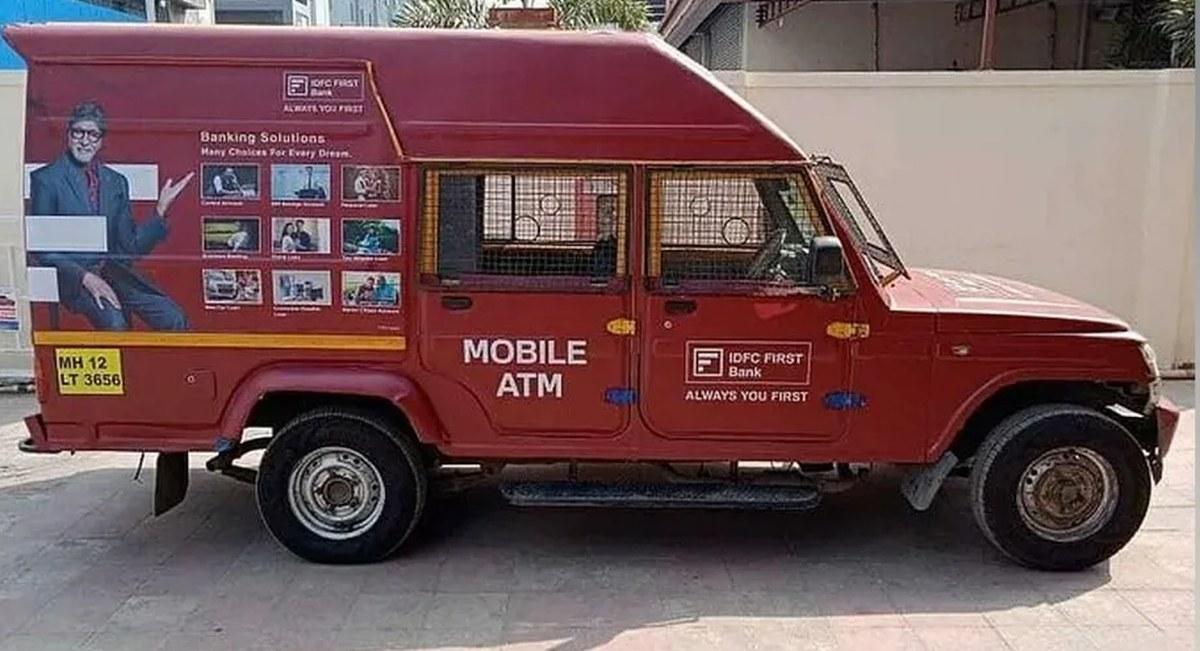

Photograph: Courtesy: IDFC First Bank Photos/Wikimedia Commons

Last month, IDFC First Bank board had approved a preferential equity issue of about Rs 4,876 crore to Currant Sea Investments BV, an affiliate company of investor Warburg Pincus LLC.

Following that, the bank sought shareholders’ nod through postal ballot to amend the Articles of Association of the bank.

It sought their approval to provide a right to Currant Sea Investments BV(or any of its assignees) to nominate one non-retiring non-executive director by way of a special resolution.

As per the results of the postal ballot disclosed to the stock exchanges on Monday, only 64.10 per cent of the votes were in favour of the resolution, while 35.90 per cent were against it.

“… The special resolution… has not been passed due to lack of requisite majority,” IDFC First Bank said in a BSE filing.

Under Company Law, a special resolution is passed if the proposal gets at least 75 per cent of votes in favour of it.

In the IDFC First Bank special resolution, votes were cast by 76.08 per cent of the total institutional investors, and 27.53 per cent of the total non-institutional or retail investors.

Notably, 51.30 per cent of institutional investors in the bank voted against the resolution, while the remaining 48.7 per cent were in favour of the appointment of a director by Currant Sea Investments on the bank board.

However, 98.67 per cent of the total non-institutional or retail investor votes were in favour of the resolution and 1.33 per cent against it.

Thus, the total votes polled by institutions and retail investors in favour of the resolution stood at 64.10 per cent and 35.90 per cent against it.

Separately, the bank’s shareholders have approved the other two resolutions through postal ballot.

One of them pertained to a special resolution to issue, offer and allot compulsorily convertible cumulative preference shares of Rs 7,500 crore on preferential basis, to be compulsorily converted to equity shares.

It was passed with 99.18 per cent of votes in favour.

The second was ordinary resolution to re-classify authorised share capital of the bank and consequent amendment in the capital clause of the Memorandum of Association of the bank.

This saw 99.61 per cent votes polled in favour.

Earlier this month, Warburg Pincus, through its arm Currant Sea Investments, had sought Competition Commission of India (CCI) nod to acquire 9.99 per cent stake in IDFC First Bank by subscribing to over 81.26 crore compulsorily convertible cumulative preference shares.

Shares of IDFC First Bank were trading at Rs 69.14 apiece, down 0.16 per cent over previous close on BSE.