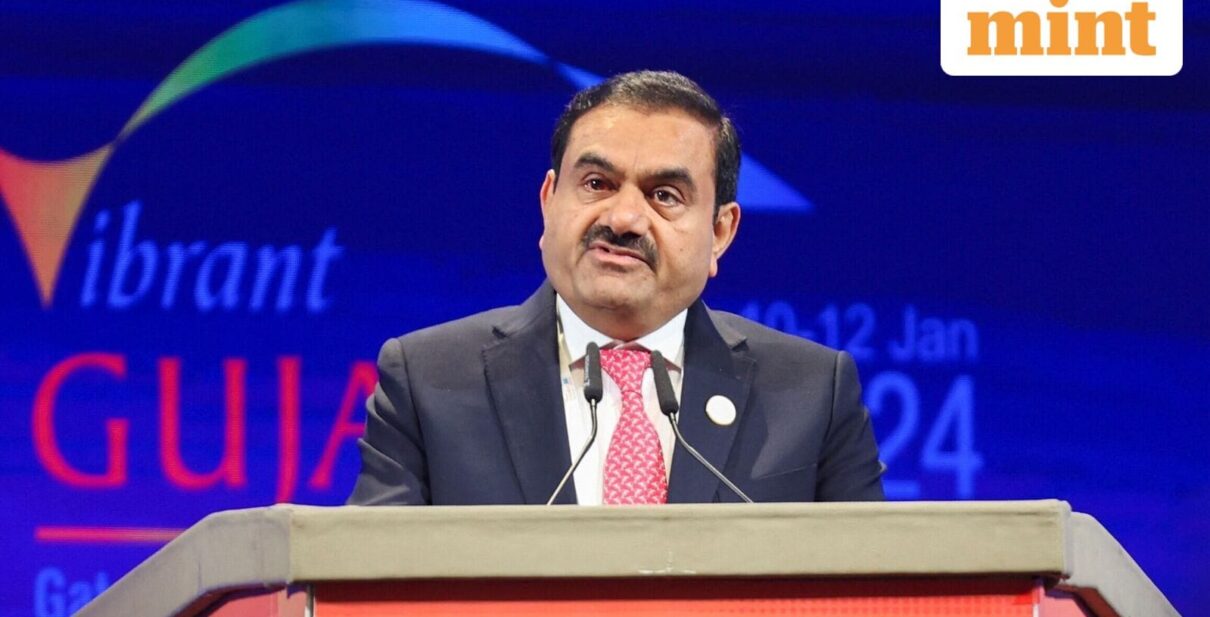

Gautam Adani’s net worth: Adani group stocks witnessed strong buying on Friday after the clearance from the capital market regulator, Securities and Exchange Board of India (SEBI), in the Hindenburg Research allegations. All Adani shares ended higher on Friday, which resulted in a ₹69,000 crore rise in the market capitalisation of Adani Group stocks. Adani Power share price led from the front and finished 13.42% higher at ₹416.10 apiece on the NSE. Adani Total Gas share price ended 7.55% higher at ₹652.80 per share on the NSE. Adani Enterprise and Adani Green Energy shares gained over 5%, while shares of Adani Energy Solutions Ltd added close to 5% in the weekend session. This rise in the market cap of Adani Group led to an increase of Gautam Adani’s net worth by ₹299 crore in a single day.

How did Gautam Adani’s net worth surge by ₹299 crore?

Gautam Adani is the Founder Chairman of Adani Group and owns Adani Group companies. As promoter of the Adani Group companies, he owns promoter stakes in Adani Group companies in various direct and indirect capacities.

In Adani Enterprises Ltd, Gautam Adani, his family members as promoter owns 67,28,25,211 Adani Enterprises shares, which surged by ₹126 apiece on Friday. This means a rise in Adani Enterprises shares led to Gautam Adani’s net worth by ₹84,77,59,76,586 or ₹8,477.60 crore ( ₹126 x 67,28,25,211).

Gautam Adani and his companies own 10,64,56,927 ACC shares in ACC Ltd. On Friday, the shares went up by ₹12.90 per share, leading to a rise in Gautam Adani’s net worth by ₹1,37,32,94,358.30 or ₹137.33 crore ( ₹12.90 x 10,64,56,927).

In Adani Energy Solutions Ltd, Gautam Adani, his family members, and his family trust own 69,92,51,987 Adani Energy Solutions, which went northward by ₹41.35 per share on Friday, leading to a rise in Gautam Adani’s net worth by ₹28,91,40,69,662.45 or ₹2,891.40 crore ( ₹41.35 x 69,92,51,987).

In Adani Green Energy Ltd, Gautam Adani, his family members, and his family trust own 80,82,47,856 Adani Green Energy shares. These shares surged ₹53.60 per share on Friday, increasing Gautam Adani’s net worth by ₹43,32,20,85,081.60 or ₹4,332.20 crore ( ₹53.60 x 80,82,47,856).

In Adani Ports and Special Economic Zone Ltd, Gautam Adani, his family members, and his family-owned companies own 92,12,83,955 Adani Ports shares. These shares went up by ₹16.20 per share on Friday, leading to a rise in Gautam Adani’s net worth by ₹14,92,48,00,071 or ₹1,492.48 crore.

In Adani Total Gas Ltd, Gautam Adani, his family members, and his family-owned trusts and companies own 41,13,31,740 Adani Total Gas shares, which rose ₹45.85 per share on Friday. This led to a rise in Gautam Adani’s net worth by ₹18,85,95,60,279 or ₹1,885.95 crore.

In Ambuja Cements Ltd, Adani Group-owned offshore investment companies own 1,66,33,81,052 Ambuja Cements shares, which went up ₹1.80 per share on Friday, leading to a rise in Gautam Adani’s net worth by ₹2,99,40,85,893.60 or ₹299.40 crore.

So, Gautam Adani’s net worth rose due to the rise in Adani Group stocks after getting clearance in Hindenburg Research allegations to ₹2,99,41,05,110.56 or ₹299.41 crore.

Adani news

The rally came just a day after SEBI concluded its investigation, stating that it found no evidence to support the accusations raised by US-based short seller Hindenburg Research in early 2023. Those allegations had erased nearly USD 150 billion in market value across Adani Group stocks at their peak, sparking a global debate on governance, transparency, and political influence. Therefore, the clean chit is seen as a watershed moment for the conglomerate and a significant relief for investors waiting for regulatory clarity before taking fresh positions.

Adani Group companies dominated the top gainers list on the exchanges, and the trading volumes in these counters reflected heightened investor activity. The surge was particularly notable in energy-related stocks, but the impact was broad-based across the group, from its flagship incubator company to its media arm.

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of individual analysts or broking firms, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.