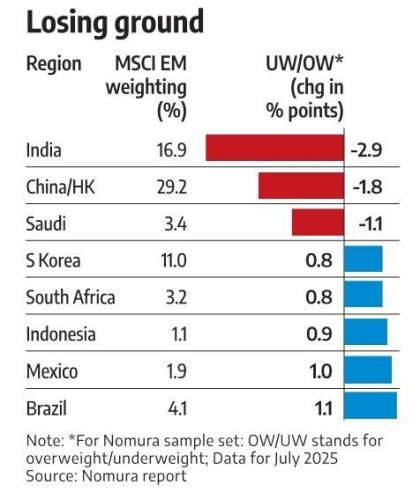

Global emerging market investors are sharply cutting back on India, making it the largest underweight market, as funds rotate into China, Hong Kong, and South Korea amid tariff shocks and valuation concerns.

Illustration: Dominic Xavier/Rediff

India is rapidly losing favour with global emerging market investors, with the latest fund flow data showing one of the steepest cutbacks in allocations to Indian equities in recent months.

According to an analysis done by Nomura of 45 large EM funds, relative allocations to India fell by 110 basis points (bps) month-on-month (M-o-M) in July, with as many as 41 funds reducing exposure.

This marks India out as the largest underweight (UW) market in EM portfolios, with allocations standing at a negative 2.9 percentage points relative to benchmark MSCI EM index.

In contrast, Hong Kong, China and South Korea have emerged as the key beneficiaries of this regional rebalancing.

Allocations to Hong Kong, China and South Korea rose by 80 bps, 70 bps and 40 bps, respectively, reflecting a decisive rotation in foreign portfolios.

In the Nomura sample set, 37 of the 45 funds increased their exposure to Hong Kong and China while 29 did so in case of South Korea.

The tilt is significant as it comes at a time when India continues to trade at a valuation premium to EM peers.

By the end of July, 71 per cent of EM funds were underweight on India, up from 60 per cent in June.

In comparison, the percentage of funds underweight on Hong Kong, China, dropped sharply from 71 per cent in June to 53 per cent in July, suggesting sentiment towards Chinese equities is turning less bearish.

South Korea, meanwhile, has moved into overweight territory, with 60 per cent of EM funds now overweight versus a more balanced split previously.

The Nomura report said July proved to be a tough month for managers overall, with only 7 out of 45 EM funds outperforming the MSCI EM Index.

However, early August trends suggest performance has improved, with 35 funds outperforming month-to-date.

The fund flow data also corroborates the latest Bank of America (BofA) Fund Manager Survey.

Last week, the survey had revealed India had now sunk to the bottom of the investor preference list after being at the top as recently as May.

The shift in sentiment is widely attributed to US President Donald Trump’s announcement of 50 per cent tariffs on Indian goods, including a 25 per cent penalty for India’s Russian oil imports, which investors fear will dent corporate earnings and further strain already high market valuations.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Rajesh Alva/Rediff