Jain said CleanMax focuses on directly supplying renewable power to corporate customers rather than selling electricity to distribution companies.

He said, “Clean Max owns renewable energy power plants, both solar and wind power plants, and we sell the power so produced, 100% of it to corporate customers.”

Also Read | Kwality Wall’s targets distribution expansion, double-digit volume growth after listing

The company said around 78% of revenue comes from direct power sales to corporate customers, while the remaining share comes from EPC and services.

Jain said technology companies and AI infrastructure firms form a large part of CleanMax’s customer base. “As of December 25, 43% of our contracted capacity was for data centres and AI companies.”

The company supplies renewable power to large global technology firms and other industrial customers, aiming to reduce power costs and emissions.

Jain said renewable power sales generate higher margins compared with the EPC business, leading to faster earnings before interest, taxes, depreciation, and amortisation (EBITDA) growth than revenue growth.

Also Read | Yotta Data Services plans $1 billion fundraise to ramp up AI infrastructure, eyes IPO this year

He said energy sales deliver gross margins of over 90%, while EPC projects deliver lower margins. This shift in revenue mix supported EBITDA growth of about 58% over the past three years.

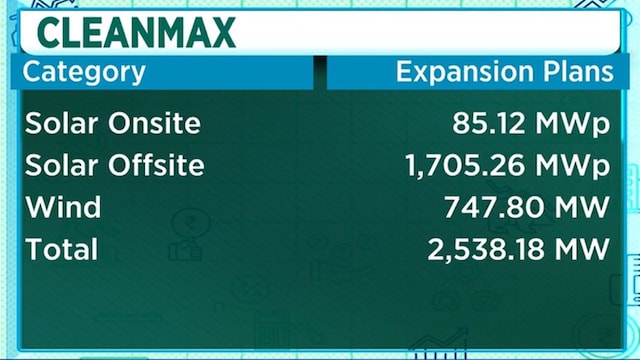

The company said it currently has over 3 GW of operational capacity and nearly 3 GW of contracted capacity expected to be commissioned over the next two years.

Jain said, “We have 2900 megawatt contracted, which should be slated to come on stream in the next couple of years.”

He added that long-term power purchase agreements (PPAs) of around 23 years provide revenue visibility and support debt financing structures.

He said net debt to EBITDA stands at around 4.8 times, lower than industry averages.

Jain said corporate customers prefer predictable power costs under long-term contracts rather than exposure to spot market volatility.

He said, “Corporates prefer everyday, low, predictable prices.”

He added that the company has signed more than 1,500 PPAs with no major disputes reported.

The company has set the price band for its upcoming initial public offering (IPO), which will open for subscription on February 23 and close on February 25. The anchor investor portion will open on February 20.

For the full interview, watch the accompanying video

Catch all the latest updates from the stock market here