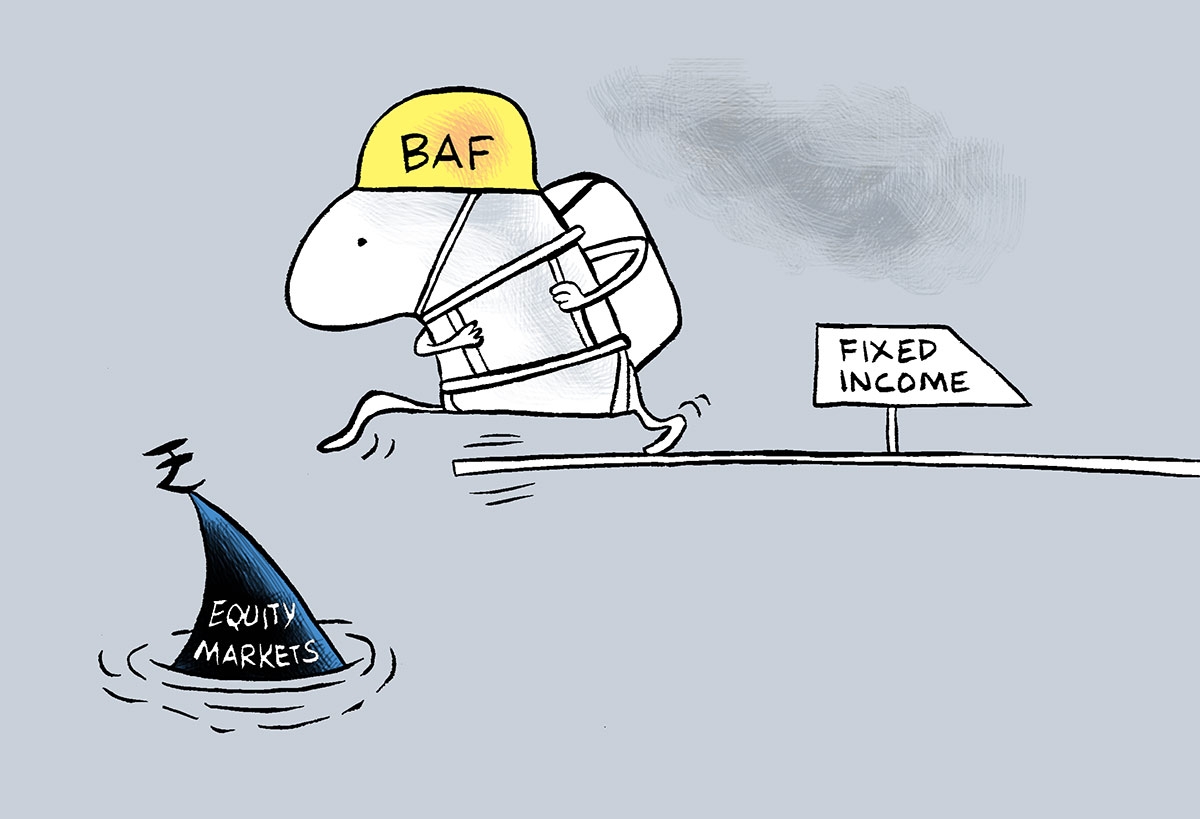

Balanced advantage funds (BAFs), which adjust between stocks and bonds depending on market conditions, have increased their equity holdings over the past year, with most schemes now predominantly invested in equities.

Illustration: Uttam Ghosh

Net equity exposure in the category had dropped to a low last August, as elevated stock market valuations titled the risk-reward scale towards debt.

Fast forward a year, the five largest schemes, excluding Edelweiss BAF, which follows a contrarian allocation model, held an average equity exposure of 55.5 per cent as of August this year, up from 42.8 per cent 12 months ago.

“BAFs have recently increased their net equity exposure, with several schemes now holding over 60 per cent in equities.

“This surge reflects both model-driven signals (based on valuations and sentiments) and the broader shift in market expectations toward continued growth with contained inflation,” said Jiral Mehta, senior research manager at FundsIndia.

While models vary across funds, most rely on equity valuations as a key input.

Rahul Singh, chief investment officer-equities at Tata Asset Management, said the decline in valuations has been the main driver of the higher equity allocation.

“Compared to three or six months ago, today’s lower price-to-earnings ratio has been taken into account while increasing the equity allocation.

“The model also incorporates scoring based on technical and momentum factors, which continue to remain moderately positive.

“The combination of these two factors has led us to increase the equity portion in the fund,” he said.

The trailing 12-month price-to-earnings ratio of the Nifty 500 fell to 24.3 from 27.2 over the past year, reflecting both price and time corrections in the equity market.

Hybrid funds, including BAFs, have gained favour in recent years amid high equity valuations and global uncertainties, offering flexibility to adjust to market conditions.

They are often recommended as all-weather options for investors with lower-risk appetite.

“Irrespective of the market environment, BAF is a good investment option for cautious investors who want to participate in the long-term growth potential of equities and at the same time want to limit the short-term downside risk.

“One of the biggest challenges for investors is to avoid behavioural biases.

“BAF helps in overcoming such biases as their allocation decisions are typically driven by pre-determined asset allocation models incorporating various parameters including growth and valuation levels,” said Nilesh D Naik, head of investment products at Share.Market (PhonePe Wealth).

Lower equity exposure earlier this year helped BAFs generate positive returns while many equity funds slipped into negative territory.

The category delivered an average return of 3 per cent over the past year.