The country’s biggest carmaker, Maruti Suzuki India, has raised concerns about the continuing slide in small car sales.

Kindly note the image have only been published for representational purposes. Photograph: Siphiwe Sibeko/Reuters

India’s automobile market is witnessing a curious phenomenon.

While the middle class is increasingly unable to transition from two-wheelers to entry-level cars, the sport utility vehicle (SUV) segment is recording a rising share of first-time buyers.

The country’s biggest carmaker, Maruti Suzuki India, has raised concerns about the continuing slide in small car sales.

Last month, Chairman R C Bhargava warned that unless this segment returns to a growth path, overall passenger vehicle sales in India will remain sluggish.

Yet even as small cars falter, SUVs are finding favour with new buyers.

Hyundai Motor India has witnessed a sharp rise in first-time car buyers — their share climbed from 31.6 per cent in FY20 to 40.1 per cent in FY25, said Tarun Garg, whole-time director and COO of the company.

Mahindra & Mahindra (M&M), another SUV player, said one in three buyers of its XUV3XO belongs to the first-time car-owner category.

Passenger cars made up 65 per cent of total sales of passenger vehicles, including cars, utility vehicles and vans, in 2018–19.

That share declined steadily to 31 per cent in 2024–25. Despite this drop, passenger cars were still sold in large volumes — 1.3 million units in FY25.

Bhargava blamed affordability issues for the challenges facing entry-level car sales.

“Only around 12 per cent of households in India earn over ₹12 lakh annually and can consider buying a car priced at ₹10 lakh or more,” he said.

That means 88 per cent of Indian households are effectively locked out of the car market, he argued.

Regulatory changes — including tighter safety and emission norms –have pushed up car prices, while salaries have largely stagnated. A Maruti Celerio that sold for ₹2.8-4.4 lakh in 2016 now costs between ₹5.6 lakh and ₹6.7 lakh. Unsurprisingly, many buyers are turning to the used car market, which has been growing at a double-digit pace over the past two-three years.

Photograph: PTI Photo from the Rediff Archives

Niraj Singh, founder and CEO of used car platform Spinny, told Business Standard that India’s used car market, growing at 10–12 per cent annually, is projected to hit $40 billion by FY26.

“This translates into an expected 6.5-7 million used car sales in terms of volumes.”

The job market hasn’t helped. Shantanu Rooj, founder and CEO of TeamLease Edtech, said fresher salaries have been stagnant for 5–7 years, mostly hovering between ₹2 lakh and ₹4 lakh annually.

With annual pay hikes of just 5–7 per cent, many young earners are struggling to keep pace with inflation.

Furthermore, jobs are concentrated in a few major cities, meaning those who relocate often have less disposable income, Rooj said.

“There’s also growing volatility in the job market, with artificial intelligence (AI) replacing some roles. In such a scenario, people would usually prioritise saving, rather than making big-ticket purchases like cars.”

For Bhargava, the solution lies in making small cars more affordable. “That requires lower taxes and a reduction in the cost of regulations,” he had said.

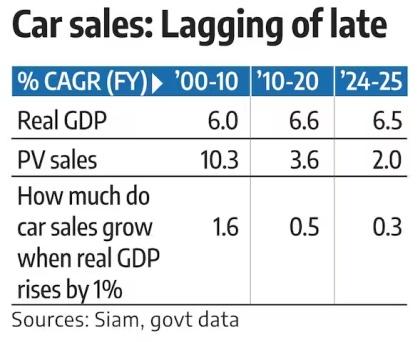

The link between GDP growth and PV sales is weakening.

From 1999-2000 to 2009-2010, GDP grew at a compound annual growth rate(CAGR) of 6.3 per cent, while PV sales grew at 10.3 per cent.

Between 2010-2011 and 2019-2020, GDP CAGR rose slightly to 6.6 per cent, but PV sales slowed to 3.6 per cent. In FY25, PV sales grew just 2 per cent, even as GDP expanded by 6.5 per cent.

A senior industry executive noted a troubling trend. India has 213 million two-wheelers on the road, of which 100 million were sold in the past 5–7 years.

“There are at least 113 million two-wheelers which are older than that and the owner can consider an upgrade. However, we don’t see these buyers in the market. The first buy for a two-wheeler upgrader is almost always a small car,” the executive explained.

He cited data from People Research on India’s Consumer Economy, which showed that in households earning up to ₹7 lakh annually, car penetration fell from 13.9 per cent in FY16 to 9.4 per cent in FY20, while two-wheeler ownership rose from 57 per cent to 66.3 per cent.

The composition of the PV market has shifted accordingly, with SUVs and multi-purpose vehicles now accounting for 65 per cent of sales.

M&M, which focuses solely on this segment, reports that a third of XUV3XO buyers are first-time owners.

Nalinikanth Gollagunta, chief executive of M&M’s automotive division, attributed SUVs’ popularity to their features, safety credentials and comfort–qualities, he said, make such vehicles an “ideal choice” for car buyers.

Hyundai agrees. Two out of every three vehicles it sells in India are SUVs. A senior company executive attributed the shift to changing aspirations and easier access to vehicle finance.

There’s also an income divide. Industry experts say the average monthly income of an entry-level car buyer is ₹65,000–75,000, while SUV buyers earn between ₹75,000 and ₹90,000.

Demand for premium cars is expected to get only stronger. According to a Grant Thornton report, India’s “affluent class” is expected to nearly double to 100 million over the next three years.

“Strong economic growth, stable monetary policy, and high credit growth have contributed towards increasing the purchasing power of top-earning Indians over the past decade,” the report said. “As disposable income increases further, PV sales are expected to grow in the coming years.”

That income is increasingly being used to buy bigger, better-equipped cars. Top earners not only prefer larger vehicles, but also those with premium features.

“The share of ADAS-equipped variants has more than doubled in a year — from 6.7 per cent in FY24 to 14.3 per cent in FY25,” Garg said.

“And 53 per cent of the cars we sold in FY25 came with a sunroof, up from 48 per cent the previous year.”

It’s a story of two Indias — one revving ahead in SUVs with all the trimmings, the other stuck on two wheels and waiting for the road to rise.

Feature Presentation: Rajesh Alva/Rediff