Alternative investment funds (AIFs) have crossed Rs 5 trillion in terms of funds raised, while the investment commitments have surpassed Rs 12 trillion for the first time as of September, according to data released by the Securities and Exchange Board of India (Sebi).

On a year-on-year basis, the funds raised and commitments in AIFs have surged by around 30 per cent each, with wealthy individuals embracing the investment vehicle in search of better returns.

AIFs are pooled investment vehicles for the affluent, where investments are drawn in tranches, meaning that funds raised trail the commitment amount.

Nearly 70 per cent of these investments are in the unlisted market, where returns can be outsized compared to traditional equity investments in the listed space.

The total investments made by the AIFs have inched closer to Rs 4.5 trillion.

However, real estate continues to command the highest share of investments, at Rs 75,000 crore, or nearly 16.5 per cent of the total investments.

AIFs have higher entry barriers as they invest in more niche products, such as unlisted assets, startups, private credit, and other riskier assets.

AIFs offer access to absolute return products across both liquid and illiquid asset classes, including derivatives, private equity, infrastructure, fixed income, and credit.

Regulatory reforms introduced by Sebi, aimed at enhancing transparency, have significantly bolstered investor confidence in the AIF sector, said Deepak Sood, partner and head of fixed income at Alpha Alternatives.

The growing wealth in India, coupled with the need for diversified asset allocation, is driving the AIF industry; this is further supported by enabling regulatory reforms, said Rakshat Kapoor, head of private credit and chief investment officer at Modulus Alternatives.

Over the past few years, Sebi has stepped up its monitoring of AIFs and has implemented measures such as valuation, benchmarking, mandatory dematerialisation, and norms on liquidation, which have helped the growth of the segment, according to industry players.

The market regulator has recently proposed changes to the norms governing angel funds, which currently fall under Category I of AIFs and account for over Rs 4,500 crore in funds raised.

The proposals aim to ease certain norms and allow smaller investments by angel funds.

However, this may be restricted to accredited investors to address concerns about exposure to high risk.

AIFs that invest in startups, early-stage ventures, and small and medium enterprises fall under Category I AIFs.

Category II AIFs, which account for nearly two-thirds of the investments made, invest in real estate funds, private equity funds, funds for distressed assets, etc.

The third category includes hedge funds and other funds that use complex trading strategies.

There has also been a surge in the private credit space, with many companies seeking capital from alternative sources beyond banks and non-banking financial companies.

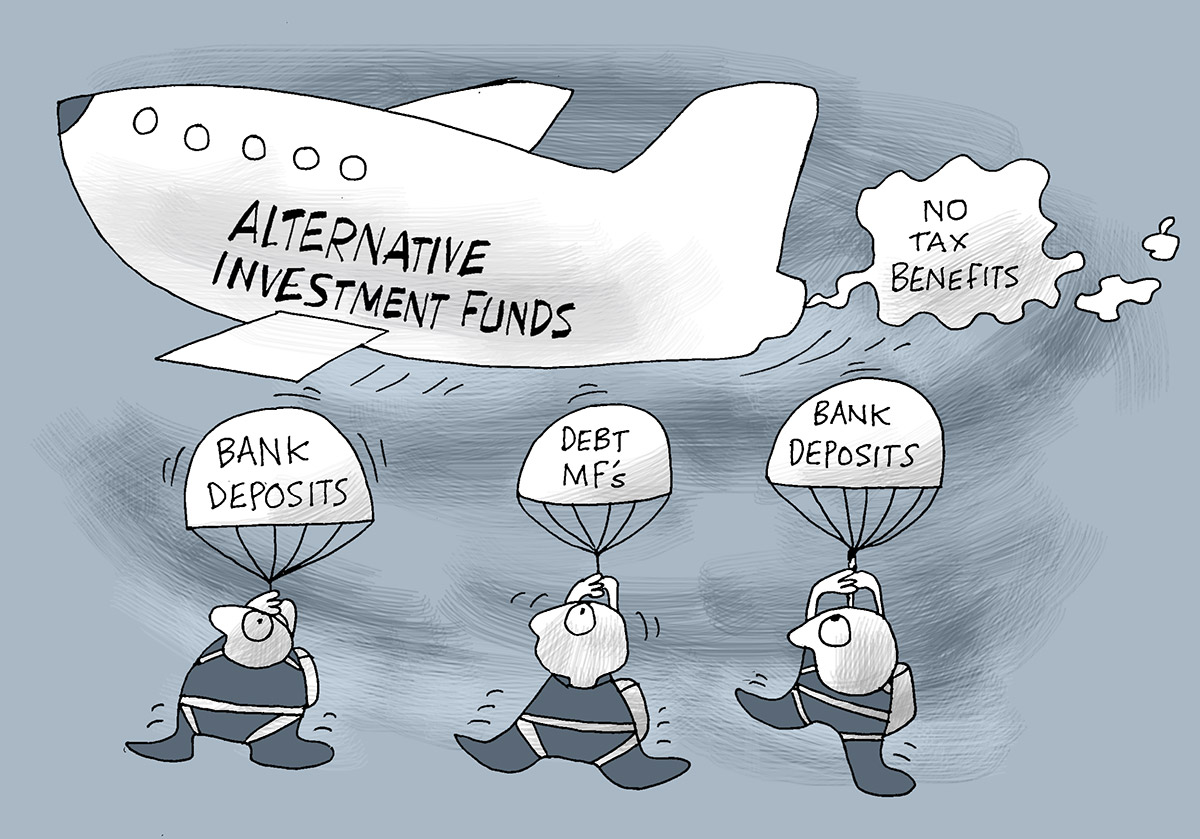

The multifold growth of private credit within the AIF segment is primarily driven by higher yields, regular income, and well-managed, contained risk as compared to traditional regular-income investments.

We see this macro trend continuing for some time, added Kapoor.

Experts also attribute the growth in AIFs to the rise in the affluent class and investments from family offices seeking consistent performance and high-yielding assets.

Earlier this year, financial regulators raised concerns about the circumvention of key regulations through AIFs, with the amount under scrutiny reaching several thousand crores.

However, the RBI and Sebi intervened to curb such instances and imposed certain restrictions.