‘The market today is different — more mature and conducive. As a national player, you can’t not be in Mumbai. And competition is always good.’

IMAGE: The construction site of a residential apartment building by property developer DLF Ltd. Photograph: Adnan Abidi/Reuters

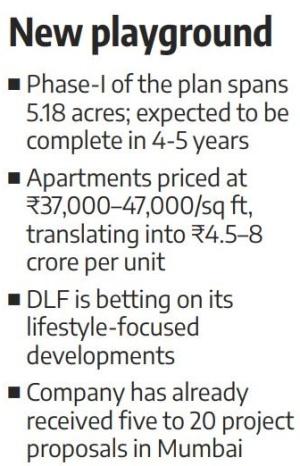

Gurugram-based DLF, India’s top listed real estate developer, has re-entered the Mumbai market with a premium residential project, investing ₹800–900 crore in the first phase, which is expected to generate around ₹2,300 crore in revenue.

The first phase of the project, West Park (Andheri West), includes four 37-storey residential towers with a total of 416 units and is scheduled for completion in the next four years.

Spread across 5.18 acres, this phase is part of a larger 10-acre master plan that will eventually feature eight distinct towers.

DLF is executing the project in partnership with Trident Realty, another Gurugram-based developer with some ongoing projects in Mumbai.

The development falls under the Slum Rehabilitation Authority (SRA) scheme. However, DLF will only handle the greenfield portion, while Trident oversees the SRA component.

DLF holds a 51 per cent stake in the project, with Trident owning the remainder.

The development will offer a mix of 3/4BHK residences ranging from 1,125 to 2,500 square (sq) feet (ft), along with a limited number of exclusive penthouses.

Prices will range from ₹37,000 to ₹47,000 per sq ft, translating into ₹4.5–8 crore per unit.

The second phase is likely to launch next year and is projected to generate ₹2,300–2,500 crore in revenue.

Photograph: Amit Dave/Reuters

Aakash Ohri, joint managing director and chief business officer, DLF Homes, said the company is focused on portfolio diversification and is taking Mumbai “very seriously”.

“Mumbai and Delhi are going to be two big markets for us because they’re the ones that are going to give us our returns,” he said.

DLF’s residential portfolio currently includes projects across Gurugram, Lucknow, Chandigarh, Panchkula, Kochi, Chennai, and Delhi, in addition to the new Mumbai development.

Ohri added that the company has already received five to 20 project proposals in Mumbai.

“We want to get this product off the ground first, show some strength and capability, and then look at doing more projects in Mumbai,” he said.

DLF is betting on its lifestyle-focused developments and strong balance sheet.

“What we bring to the table is the lifestyle story. That’s what sets DLF apart. We won’t operate in any city, including Gurugram, unless the margins make sense. We don’t have to. We’re a debt-free, cash-rich company with land banks that can sustain us for the next 25 years. Why take on unnecessary stress? We’ve got nothing to prove,” Ohri said.

In 2012, DLF had exited Mumbai as part of its debt-reduction strategy, selling a prime 17-acre parcel in Lower Parel to Lodha Developers (erstwhile Macrotech Developers) for ₹2,700 crore.

“That exit was part of our overall strategy. Of 22 cities, one didn’t work out. That’s fine. At the time, Gurugram needed a lot of attention, and our future was tied to that market. Even with the land deal, we exited at a good premium. It wasn’t a loss,” Ohri said.

This time, the company is more confident, pointing to strong interest from channel partners.

“There’s never really a right or wrong time. The market today is different — more mature and conducive. As a national player, you can’t not be in Mumbai. And competition is always good,” he said.

Mixed response from industry

However, the move has drawn a mixed response from sector experts.

Gulam Zia, senior executive director at Knight Frank India, said DLF is entering at a time when the market is showing signs of fatigue and nearing the top of the cycle.

“The next two to three years will be tough. You need to stay invested long enough to reap the rewards. Since it’s a large development of more than 17 acres, they’ll be building over at least one or two market cycles. The entry point is challenging,” he said.

Zia also noted that Mumbai buyers may not be swayed by DLF’s luxury reputation in Gurugram.

However, a sector analyst said DLF could benefit from its brand value, the project’s location, and the vibrancy of Mumbai’s real estate market.

“The company wants a foothold in a market like Mumbai and better realisations,” the analyst said.

Another expert pointed out potential challenges, citing the company’s past exit, the hyperlocal nature of Mumbai real estate, and stiff competition from well-entrenched local players.

Feature Presentation: Rajesh Alva/Rediff